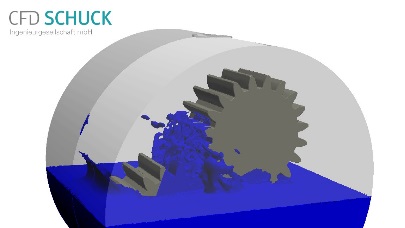

Team 58 – Simulating wind tunnel flow around bicycle and rider.

3 – The HPC cloud market, providers and applications

While the general enterprise cloud services market is currently reaching 5% of the overall IT spending worldwide, HPC in the cloud is still somewhat behind. The only market data currently publicly available for HPC clouds was produced by IDC for a worldwide study involving 905 HPC sites of various sizes in government, academia and industry/commerce [4], a summary of which was presented at the ISC Cloud Conference in September 2013 in Heidelberg. It showed that 23.5% of these sites used cloud computing of some type in 2013, a substantial increase from 13.8% in 2011. Of the HPC sites that use cloud computing, half use private clouds and slightly more than half use public clouds (probably at an early stage). Early adopters include: government, manufacturers, bio-life science, oil and gas, digital content creation, financial services and other high-end analytics, online consumer services and health care firms. Our own observation is that the majority of these early adopters are using cloud computing mainly for exploring this new paradigm and how it might fit into their current strategy. Only a small percentage of them are actually using cloud in production.

3.A – HPC cloud adoption for small and medium enterprises

In their study, IDC did not take into account one significant market segment: digital manufacturing, in particular those only using desktop workstations. This market is mainly composed of engineers and scientists who need advanced computing technologies for simulations and production in order to improve quality, achieve faster time-to-market and reduce costs. They can be found in a multitude of areas, such as structural analysis, aerodynamics, fluid flows, crashworthiness, environment testing, stress testing, process engineering and manufacturability. As previously noted, they primarily use workstations, but according to Jon Peddie [5], the worldwide workstation market is currently worth $7 billion in terms of revenue, with around 3.5 million units shipped last year. That’s easily in the neighborhood of 20 million users, mainly using workstations and PCs for their daily design and development simulations, making them potential candidates for HPC clouds, let alone those manufacturers who don’t use computing at all (sometimes called the ‘missing middle’) or even the knowledgeable amateur who could do a lot with sufficient computing power, in the context of 3D printing for example.

A confirmation of this potential can be found in an Intersect360/NCMS study on Modeling and Simulation at 260 U.S. Manufacturers [7], which we believe is still valid today. This study shows that in 2010, 61% of companies with over 10,000 employees were using HPC, whereas only 8% of companies with fewer than 100 employees were. Meanwhile, at the same time, 72% of desktop CAE users saw a competitive advantage in adopting more advanced computation. Obviously, there are a few compelling roadblocks towards adopting HPC, especially in the mid-market. As previously mentioned, these roadblocks are principally the high TCO and the cumbersome procurement processes. Clearly, because of the low penetration of HPC beyond the desktop in the general manufacturing industry, the use of HPC in the cloud is still in its infancy.

And yet, there are rising hopes that this situation will change. First and foremost, because the technical press regularly addresses the various roadblocks and helps raise awareness of the many benefits of in-house HPC and HPC as a Service (HPCaaS) in the SME market of the manufacturing industry. Secondly, because there are several important trends and initiatives that foster HPC in the cloud for this same market. Thirdly, because there is a growing acceptance of general enterprise cloud computing solutions such as ERPs or CRMs, which will eventually contribute to the adoption of HPC-related services for engineering simulations on-demand.

Additionally, large manufacturing companies expect their supply chain partners to perform more and more high-quality end-to-end simulations in less time on HPC systems. And, last but not least, there are american and international initiatives like the ‘Missing Middle’, the National Center for Manufacturing Sciences, the UberCloud HPC Experiment that help promote the concept of HPC in the cloud.

3.B – A growing number of HPC cloud service providers

Over the past five years, hundreds of cloud services providers (CSPs) have entered the market, offering hardware resources, software and expertise. To name just a few resource providers: Amazon AWS, CloudSigma, Fujitsu TC Cloud, GOMPUTE, GreenButton, HP, MEGWARE, Microsoft Azure, Nimbix, OCF, Oxalya/OVH, Penguin Computing, Rescale, Sabalcore, Serviware/Bull, SGI, SICOS, TotalCAE and transtec (more providers here).

While commercial CSPs evolve, a growing number of supercomputing centers are becoming interested in offering access to their HPC clusters expertise to local and/or regional industry players on a pay-per-use basis. Examples include Georgia Tech, NCSA, Ohio Supercomputing Center, Rutgers University the San Diego Supercomputer Center in the US, the CESGA Supercomputing Centre and FCSCL in Spain, CILEA in Italy, GRNET in Greece, HSR in Switzerland, Monash University in Australia, SARA in The Netherlands and the Meso-Centres initiative in France.

In the late 90s, many digital manufacturing ISVs tried to get into the Application Service Provider business by offering access to their solutions via the web. Most of them failed because of severe (or rather insurmountable) technical or business roadblocks that couldn’t be overcome at that time. While many of the barriers have been resolved or at least softened, in the meantime many of these ISVs remain concerned that the cloud computing paradigm could potentially disrupt their existing business model based on selling annual node-locked or floating licenses. The majority of them still believe that customers might turn to on-demand cloud-based pay-per-use software services instead of buying and using software on their own systems. While this apprehension is understandable, the reality may be totally the opposite… In fact, engineers who turn to the cloud because of the above-mentioned benefits are very likely to also continue using their workstations for day-to-day standard R&D scenarios.

The cloud offers increased opportunities for engineers to do more, fasterand better simulations (and products) – see the example in [7]. For these scenarios, ISVs will sell on-demand, pay-per-use, hourly rated or subscription tokens, resulting in additional business as well as the workstation license revenues. Even for those companies which already have an HPC cluster in their computing center, bursting into a cloud offers higher efficiency and flexibility for the engineering team and for the computing center, which will more likely result in increased on-demand license business. Not to mention that ISVs offering on-demand application software will be able to attract new customers who are just beginning to work with computer simulations and who would have never considered buying a license for just a few simulations.

3.C – HPC cloud software licensing

HPC cloud software licensing is still considered one of the major barriers for the wider adoption of cloud computing. This is particularly true for SME manufacturers, as shown by a poll during an UberCloud Webinar in June 2013: the ISVs’ slow adoption of more flexible (on-demand) licensing models for the cloud was the major concern for 61% of the respondents. At the same time, things are a-changing. On the one hand, the very same ISVs that have been traditionally reluctant to provide on-demand licenses are now seriously considering them (ANSYS, SIMULIA…) or are already offering SaaS services (Autodesk Sim360, CD-adapco’s Power on Demand…). And on the other hand, a large number of major software providers – especially the ones involved in digital manufacturing or HPC tools with cloud features – are currently participating in the UberCloud HPC Experiment. Among them: Acellera, Adaptive Computing, Advanced Cluster Systems, Advection Technologies, AMPS Technologies, ANSYS, Artes Calculi, Autodesk, BGI, BlackDog Endeavors, Bright Computing, CAELinux, CEI, Certara, CHAM, Ciespace, CloudioSphere, Cloudsoft, Cloudyn, eXact, CPUsage, Cycle Computing, Datadvance, ELEKS, Equalis, ESI Group, ESTECO, Expert Engineering Solutions, Fidesys, Flow Science, Foldyne Research, Friendship Systems, Gompute, GPU Systems, HCL Infoystems, HPC Solves, HPC Sphere, Kitware, Kuava, Landmark (Halliburton), MapR Technologies, micrOcost, migenius, MSC Software, Nice Software, Nimbus Informatics, Numerate, Open Source Research Institute, Ozen Engineering, Personal Peptides, Phenosystems, PlayPinion, Qtility Software, QuantConnect, Rescale, RMC Software, SimScale, SIMULIA, Stillwater Supercomputing, TECIC, TotalSim, TYCHO, Univa and Visual Solutions…

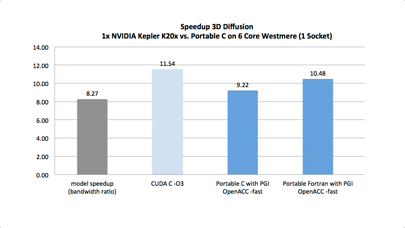

3.D – Application performance in the cloud

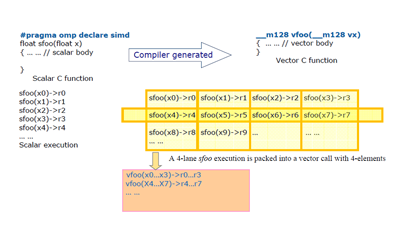

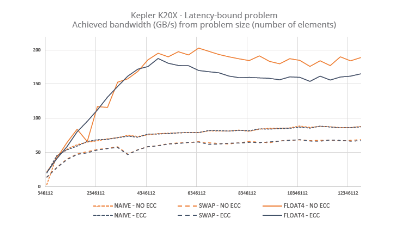

The HPC application spectrum is large. On one end, there are the so-called massively (or ‘pleasingly’) parallel applications like parameter studies in digital manufacturing and drug design. In these cases, the code runs many instances in parallel on many cores, with each parameter job running on one core; or, more globally, applications run on many servers, with each parameter job running on separate servers (with moderate parallelism on the servers’ cores). These applications seem to be well-suited for standard enterprise cloud servers. On the other end of the spectrum, parallel (distributed) applications have tightly-coupled communication needs among parallel tasks and/or high scalability requirements that would run perfectly on specialized HPC servers. A third class of codes has mid-size, mid-scale parallel requirements that can easily run on one server’s parallel cores.

Three components are necessary for a cloud datacenter to provide a single-point of access to this kind of heterogeneous HPC cloud composed of enterprise and HPC servers: a user-friendly portal providing access to the cloud, an intelligent resource manager scheduling the different application jobs to the appropriate systems within the HPC cloud and computing resources (ideally preloaded with the requested application codes).

[4] Steve Conway et al. IDC HPC End-User Special Study of Cloud Use in Technical Computing. June 2013.

[5] Jon Peddie. Workstations continue solid growth in Q3’13.

[6] Intersect360/NCMS study on Modeling and Simulation at 260 U.S. Manufacturers, July 2010.

[7] Wolfgang Gentzsch, Why Are CAE Software Vendors Moving to the HPC Cloud?

More around this topic...

In the same section

© HPC Today 2024 - All rights reserved.

Thank you for reading HPC Today.