As is customary every year at this time, IDC has just published its ten major predictions for the HPC market in 2014. Those familiar with IDC know that this document is more like an in-depth analysis of our ecosystem and its trends than a crystal ball game. And it just so happens that these trends are occurring in an evolving landscape. It starts with the now nearly universal recognition of high performance computing as an economic and strategic value giving the industry a clearly positive outlook for the longer term. Additionally, although Big Data is booming ($16.1 billion forecasted for 2014), its relevance for most businesses has yet to be established. Also worthy of note is the confirmed takeoff of Cloud Computing, as witnessed by the constant increase in offerings and players with a broad range of service types. Lastly, Lenovo’s very recent acquisition of IBM’s x86 server business is being seen as a major disruption of the dynamics in the OEM server market.

Now let’s get into details. The HPC server business declined by nearly $1 billion in 2013 after three record years, but should bounce back in 2014 and return to levels just short of the 2012 figures, in volume. IDC estimates that Lenovo’s arrival on the scene should lead to some degree of market share redistribution. So far, IBM and HP each account for about one third of this market, with Dell in third position at about 15%. According to IDC, Lenovo should be capable of matching Dell’s share.

As for supercomputers, IDC expects to see 100-PFlops systems between late 2014 and early 2015 in China, the United States, Europe (PRACE), and Japan. And when it comes to exascale systems, analysts think that their roll-out in 2020 will not be impacted by any disruptive technology, and that it is now just a matter of investment. Similarly, the study is projecting a power consumption of 20 to 30 MW, but does not expect this energy efficiency to be reached before 2022-2024.

While a high-end supercomputer currently costs between $200 and $500 million – remember that price tags rarely exceeded $100 million just 3 to 4 years ago – IDC confirms that the amount could reach one billion in the next three years. Understandably, at these levels, ROIs will have to be justified! We can therefore expect an explosion of communication on achieved results, be they scientific, economic or even societal. In addition to ROI, technology transfers and competitiveness strategies are among the main reasons why partnerships between computing centers and industry, such as PRACE and INCITE, are on the rise.

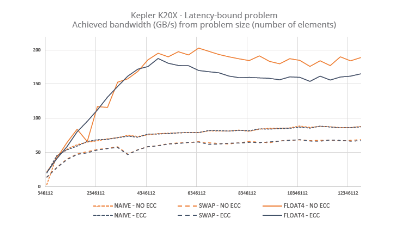

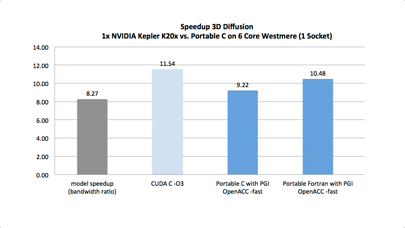

On the electronics end, IDC notes that, although coprocessors and accelerators have become mainstream (77% of high performance computing sites are so equipped versus 28% in 2011), they are still widely used for experimental purposes. So the dominance of x86 processors is not being threatened, not even close, as they still account for 80% of sales.

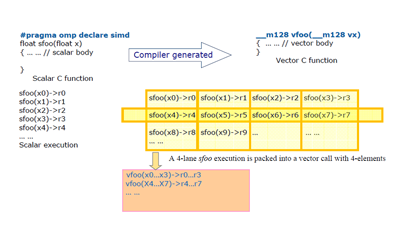

For IDC, the main reason for this roadblock to accelerator adoption is programming difficulty, or at least the necessary additional effort. The issue of the time it takes to program or reprogram an application in anticipation of the expected performance improvement is a deterrent to migration. But, somewhat surprisingly and without providing any decisive arguments, IDC expects major leadership changes in the processor market.

IDC has not forgotten storage and interconnects, which are essential elements in a data-saturated world. Sales derived from storage, the most dynamic segment of the HPC market, should reach record highs ($6 billion by 2017). However, with the flow of information being a difficult yet crucial issue, the interconnects market is in full transition, a transition gradually leading it away from the traditional computation-centric model.

And lastly, finishing with the Cloud, the number of sites using on-demand services for their HPC needs has grown from 13.8% in 2011 to 23.5% in 2013, making it a genuine trend. Here, too, the roadblocks to adoption are known: data security, transfer time, and performance of highly parallel loads. But the major players in this industry have now taken these roadblocks into account, resulting in a gradual emergence of offerings and solutions intended to solve these problems. So you can bet the real figures for 2014 will show the same progression dynamic.

© HPC Today 2024 - All rights reserved.

Thank you for reading HPC Today.