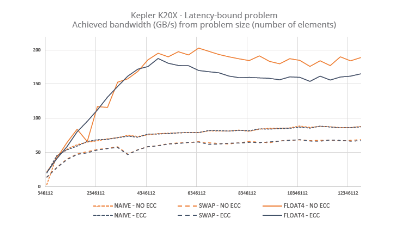

Note: Industry average for system price per processor for 1Q13–1Q15 is $3,200. Source: IDC’s Worldwide High-Performance Technical Server QView, 2015

IDC’s High Performance Technical Computing group has released its Worldwide HighPerformance Technical Server QView with technical and market data up to first quarter of 2015. Overall, the technical server market grew by more than 10% on a year-over-year basis to over $2.5 billion for 1Q15.

IDC analysts note it is worth sharing the following insights:

The IBM/Lenovo spilt is displaying some degree of conservation of mass. For the first quarter of 2015, the combined technical server revenue of IBM and Lenovo (the combination of IBM Power-based servers and Lenovo’s newly acquired x86 servers) was only about 6% less than the total IBM server revenue (Power plus x86) for the first quarter of 2014. At least in this initial phase, Lenovo has done a good job of holding onto much of the transferred IBM x86 server business.

Market share leadership has greatly shifted. Lenovo has moved up to the major leagues, while IBM moves down to triple A. Prior to this quarter, Lenovo sales were too low to move it out of ©2015 IDC #256828 2 the “other” category in the QView vendor listing. In the first quarter of 2015, Lenovo had a solid hold on third place in the technical server market, with revenue behind only HP and Dell. For its part, within the past six months, IBM fell from being the world’s second-largest technical server supplier to a distant fourth, well behind Lenovo, which in the first quarter of 2015 has more than three times technical server revenue than IBM. The IBM Power business is showing some strong momentum for the future, such as the large CORAL procurement wins and OpenPOWER Foundation gains, but it will take some time to reach full speed.

Chinese suppliers are making inroads. Chinese technical server vendors appear to be making a move against their competitors in the United States and Japan. In addition to Lenovo’s explosive growth — essentially a strong reflection on the ability of the firm to retain IBM x86 customers — another Chinese technical server supplier, Sugon, saw its first-quarter 2015 yearover-year revenue increase by over 60%. Although Sugon is only about one-seventh the size of Lenovo — and is currently making sales primarily in the Chinese market — its overall growth rate is outpacing most competitors. Lenovo has said publicly that it expects to lose some IBM x86 server business worldwide but make up for this with increased business in China. But Lenovo is pushing hard into the European high-performance computing (HPC) market by joining the European Technology Platform for HPC (ETP4HPC) and establishing a European HPC innovation center in Stuttgart, Germany.

The high end is decidedly not for the faint of heart. The highest end of the technical server sector continues to display a significant degree of choppiness, with huge variations in revenue from one quarter to the next. For example, Cray saw its 4Q14–1Q15 revenue decline by more than 80% (4Q14 was typically very strong for Cray) while realizing a 1Q14–1Q15 annual revenue increase of over 30%. Likewise, Atos-Bull of France saw its 1Q14–1Q15 revenue increase by over 40%, while its 4Q14–1Q15 revenue declined by almost the same percentage.

Figure 1 shows the ratio of total technical systems revenue-to-processor counts in those systems for each of the major technical server suppliers across the past nine quarters and reveals that:

- Post the sale of x86 servers to Lenovo, IBM technical server systems’ price per processor has increased significantly (from about $3,800 per processor to well over $5,400 per processor), reflecting the increased complexity — and associated cost — inherent in IBM’s remaining Power-based server lines.

- Not surprisingly, Lenovo x86 servers heretofore marketed by IBM have a much lower average system price per processor than IBM Power servers, and they are much more in line with other technical server suppliers that rely primarily on x86 components and related technology. Lenovo’s economies of scale and singular focus on x86 servers could make the company a much stronger competitor.

- NEC, Cray, and SGI technical servers — which use more nonstandard, in-house, and proprietary hardware (in addition to their use)

- Despite concerns that some white-box suppliers — many of which are currently counted in the “other” category — may be driving the server sector into a race to the bottom, Dell continues to offer the lowest overall system price per processor. Indeed, the average system price per processor for the “other” category has generally increased over the past nine quarters, and vendors are currently realizing almost $500 more per processor for their systems on average than Dell.

Future Outlook

Data contained in the Worldwide High-Performance Technical Server QView and discussed here indicates that there are a number of emerging trends that bear close observation in the near term as they can have a significant impact on both suppliers and buyers within this sector. Trends to watch include:

- IBM’s drive to rely exclusively on the company’s more powerful but relatively expensive Powerbased systems to drive future sales

- Lenovo’s continued retention of IBM customers — and perhaps even expansion into a new base of customers — for the company’s x86 servers, particularly within China and Europe and, to a lesser extent, in the U.S. market; likewise with Sugon as it attempts to expand its reach in China and move out into foreign markets, starting in Asia

- The continued growth of smaller, more differentiated technical server suppliers — like NEC, Cray, SGI, Fujitsu, Hitachi, T-Platforms, and Atos-Bull — to develop and compete effectively with relatively higher-cost and higher-performance systems using more proprietary and custom technology

- The growth of white-box suppliers — that saw a 26% first-quarter 2015 year-on-year growth rate — that appear to be targeting the major brand-name technical server vendors with more than just lower prices

© HPC Today 2024 - All rights reserved.

Thank you for reading HPC Today.