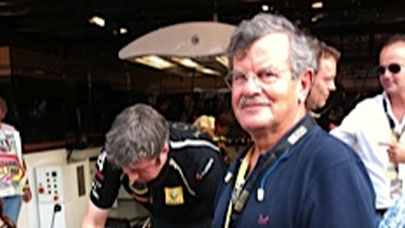

Erik Vynckier, CIO of AllianceBernstein

Back in 2008, the global economy came crashing down sending many organizations and individuals into a state of financial ruin. Three major banks in Iceland collapsed, forcing the country into a deep recession. Fingers were pointed at the banking institutions — bank officers and mortgage lenders were blamed for abusing their fiduciary duties toward their customers by putting indulgence and manipulative greed above the stability of the society.

Since then regulations have been strengthened and the financial industry has adopted sophisticated mathematical models and high performance computing systems to study and assess all types of risks in the attempt to minimize them. However, is this practice sufficient enough to assure that our money is safe with the banks and their investment strategies are sound?

Erik Vynckier, CIO of AllianceBernstein, will be speaking about “High Performance Computing in the Financial Industry: Problems, Methods & Solutions,” at the upcoming ISC conference in Frankfurt, Germany in July, which focuses on supercomputing technology in research and enterprise settings.

Prior to entering investment banking and later joining the insurance sector, you had also spent a considerable amount of time in the petrochemical industry. What were some of the connections you make there now with respect to complex modeling and the systems required to do it well?

Vynckier: Mathematical modeling and technology are great unifiers of knowledge across sectors. You can change application domains, and by catching up on the knowledge base, quickly re-establish yourself in a new area.

The mathematics and the quantitative modeling expertise, as well as the development & implementation of numerical programs aren’t necessarily all that different in the financial sector from the industrial sector.

There is one danger to watch out for however: simple one-for-one porting of models from one context to another, without paying mind to the actual mechanisms at work in the application is very naive and risky. The devil hides in the details!

In fact, scientific models poorly ported to the financial arena led to some grave mistakes and even catastrophic failures. IIl-adapted models that didn’t fit the financial markets were crudely implemented, often without questioning or investigating the key assumptions that made them successful in science. In this way, poor modeling contributed to and aggravated the credit crisis.

So how did this all translate into the financial modeling realm?

Vynckier: At previous companies I have implemented a high performance computing platform for real-time, dynamic cross-asset hedging of guaranteed life assurance policies. I also developed a scenario tool for the projection and stress testing of derivative overlays commonly used in liability driven investment strategies. Accurate valuation, accurate hedging, optimal collateral planning and confident product development resulted – all on the same platform. Sharing an integrated platform across different functions and departments limits development costs and increases the speed of developing and bringing to market new financial products.

© HPC Today 2024 - All rights reserved.

Thank you for reading HPC Today.